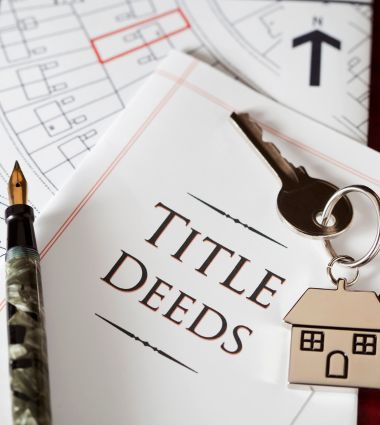

The Role of Title Insurance in Ontario Real Estate Transactions: Do You Need It?

Buying a home in Ontario is a big milestone, exciting, a little nerve-wracking, and packed with decisions you probably didn’t expect to make. One term you might hear tossed around during the closing process is "title insurance". And if you’re like most people, your first thought is: Do I really need this, or is it just another fee added to the pile?

Here’s the simple version: title insurance in Ontario isn’t just a nice-to-have. It can be the difference between a smooth property ownership experience and a legal headache you didn’t see coming. Imagine finding your dream home, moving in, and then months later, getting a notice that someone else is claiming partial ownership or that there’s a lien on the property you now call yours. Without title insurance, these kinds of hidden title defects could cost you thousands in legal fees and, worse, your peace of mind.

But don't worry, you’re not alone in figuring this out. Whether you're a first-time homebuyer or a seasoned real estate investor, understanding how title insurance works, what it covers, and when you actually need it is crucial. And while a real estate lawyer will usually walk you through the basics, it’s still smart to know exactly what you’re signing up for.

So, let’s break it down, plain and simple. Here’s everything you need to know about title insurance, why it matters, and how it protects your investment long after you’ve picked up the keys.

What Exactly Is Title Insurance?

Alright, let’s keep this simple: Title insurance is a one-time policy you buy to protect yourself from legal issues tied to the ownership of your property. It's not about fire damage or flooding — it’s about the paperwork, history, and legal rights tied to your home.

Think of it like a safety net. Even after all the inspections and paperwork are done, unexpected problems can pop up; maybe an old mortgage wasn’t properly discharged, or someone shows up claiming they still have a right to part of your land. Without title insurance, you could be stuck sorting out expensive, complicated legal messes.

And here’s the thing: not all title problems are obvious during the buying process. Sometimes, issues like fraud, zoning violations, or mistakes in public records can sit quietly until years after you’ve moved in. Title insurance steps in to cover legal costs, correct the title, or even reimburse you for losses, depending on the situation.

In Ontario, many lenders actually require you to have title insurance if you’re getting a mortgage. But even if you’re paying cash, it’s smart to seriously consider it. It’s a relatively small cost for the protection it offers (usually a few hundred dollars) but it can save you tens of thousands down the line.

Now, you might be thinking, “Isn’t my lawyer checking all this during the closing?” Good question, and the answer is yes, but even the most thorough title search can’t catch everything. Some risks are hidden or only arise after the deal is done. That’s why both buyers and lenders often rely on title insurance as an extra layer of protection.

What Does Title Insurance Typically Cover in Ontario?

When you’re buying a home, a lot of things can go wrong, even after you think everything’s settled. That’s where title insurance steps in. Here’s what it typically protects you against:

1. Title Defects and Ownership Issues

Sometimes, problems with the property's title aren’t discovered during a standard title search. Maybe a previous owner didn't properly transfer ownership, or there's a missing signature on an old deed. If something like this surfaces after you move in, title insurance helps cover the legal costs to fix it.

2. Fraud and Forgery

Real estate fraud is more common than you might think, especially in cities like Toronto and Ottawa. Someone might fraudulently sell or mortgage your property without you knowing. Title insurance in Ontario can help protect you if your ownership is ever challenged due to forged documents or identity theft.

3. Outstanding Liens or Debts

Imagine buying your new place only to find out later that the previous owner left unpaid property taxes or contractor debts attached to the title. Without protection, you might be responsible for paying those off. Title insurance steps in to deal with these hidden financial traps.

4. Survey and Zoning Problems

Maybe that lovely backyard deck your new house has actually violates local zoning bylaws. Or a neighbour’s fence might be sitting partly on your property. Title insurance can help resolve disputes like these, whether that means covering the legal fees or even paying to correct the problem.

(If you're curious about related issues like subletting and property rights, you might also want to check out our blog on Sublet Agreement Ontario).

5. Errors in Public Records

Mistakes happen - even in government offices. A typo in the land registry could cause headaches for your property rights down the road. Title insurance is designed to fix these kinds of bureaucratic errors so you’re not left stuck fighting an uphill legal battle.

Is Title Insurance Mandatory in Ontario?

If you're buying a home in Ontario, you can wonder, “Do I have to get title insurance?”

The short answer? It’s not legally required; but it's strongly recommended.

Lender Requirements

Most lenders will actually insist you purchase a title insurance policy before they’ll approve your mortgage. But here's the thing: the policy your lender requires mainly protects them, not you. Their goal is to make sure their investment is safe, not necessarily to protect your personal rights to the property.

That's why many homebuyers choose to get their own separate "owner's policy" on top of the lender’s policy. It’s a small extra cost that can save you a lot of money (and stress) down the line.

Buyer’s Choice

If you're buying a property outright (with no mortgage) you're technically free to skip title insurance altogether. But honestly? It’s a gamble. Without it, any hidden problems with the title become your problem the second you take ownership.

It’s like choosing to drive without car insurance: you might be fine... until you aren’t.

The Role of a Real Estate Lawyer

This is where having a good real estate lawyer in Toronto really becomes necessary. Your lawyer will review the property’s title, spot potential red flags, explain your risks, and guide you through getting the right title insurance policy, one that actually covers what you need, not just what the bank needs.

At Khan Law, we often tell clients: title insurance doesn’t replace a lawyer’s due diligence: it backs it up. Think of it like a seatbelt and airbags, and you want both.

What Title Insurance Does Not Cover

Now, before you start thinking title insurance is a magic shield against all problems, let’s be clear: it has limits.

Knowing what isn’t covered is just as important as knowing what is.

Problems You Already Knew About

If an issue was found during your home inspection or your lawyer discovered it before closing, and you went ahead anyway, title insurance usually won’t step in to help. It’s designed to cover unknown risks, not problems you willingly accept.

Example:

If you were told the backyard shed didn’t have a proper permit, but you bought the house anyway, title insurance won’t fix that for you later.

Environmental Hazards

Issues like soil contamination, asbestos, or mould inside the home? Title insurance generally doesn’t touch these. Those are seen as property condition problems, not title defects.

Physical Problems with the Property

Title insurance protects your ownership rights, not the physical structure itself. So, if you find out your roof leaks or your basement floods after you move in, title insurance isn't going to cover your repairs.

Matters Outside the Title

Sometimes problems aren’t tied directly to the ownership record. For instance, disputes with neighbours over fences or issues with how you plan to use the land (like zoning for a home business) may not always be covered. Some extended policies can offer partial coverage here, but it’s not automatic.

How Much Does Title Insurance Cost in Ontario?

If you're buying a home, you're probably already watching every dollar. So how much will title insurance set you back? Luckily, compared to the size of your investment, it's a small price to pay for peace of mind.

One-Time Premium; No Renewals

Title insurance in Ontario isn’t a monthly or yearly payment. It’s a one-time premium that you pay when you close the deal.

Once it’s done, you’re covered for as long as you own the property.

Quick Ballpark Estimate:

- For a typical residential property, title insurance usually costs between $250 and $500.

- Prices can vary depending on the property value, location, and the insurer you go with.

Factors That Can Influence the Cost

- Purchase Price: The higher the property value, the more you might pay.

- Type of Property: Condos, houses, commercial properties: each comes with its own pricing.

- Insurer Policies: Different title insurance companies may offer different rates and packages.

- Type of Coverage: Basic title insurance vs. enhanced coverage (which might protect against even more risks).

Is It Worth It?

Think about it: for the cost of a few dinners out, you could protect yourself against lawsuits, ownership disputes, and even title fraud. It’s a small investment for a lot of peace of mind.

How to Obtain Title Insurance in Ontario

If you’ve made it this far, you’re probably wondering; “Okay, so how do I actually get title insurance?” Good news: it’s not a complicated process. But it helps to understand how it works so you’re not just signing papers without knowing what you’re buying.

Typically Arranged Through Your Real Estate Lawyer

Most homebuyers in Ontario don’t shop for title insurance themselves. Instead, your real estate lawyer usually handles it as part of the closing process. They’ll recommend a title insurance provider (like FCT or Stewart Title), go over what’s covered, and include it in the paperwork when you take possession of your new place.

That’s one reason why having a good lawyer matters, they’ll make sure you’re getting the right kind of protection for your property.

Can You Buy It Yourself?

In some rare cases, yes, especially if you’re refinancing or want to add coverage after you already own the home. But for most buyers, the lawyer route is simpler, faster, and safer.

What You’ll Need to Provide

There isn’t a ton of paperwork on your end. But your lawyer may ask for:

- The property address

- Purchase price

- Basic details about the property type (condo, detached home, etc.)

- A quick check of the title and any red flags (which they’ll usually handle for you)

Timing: When Is It Purchased?

Title insurance is arranged before closing, often a few days or weeks prior. Once it’s in place and the deal closes, you’re covered.

Buying a home in Ontario comes with a lot of moving parts, and title insurance is one of those behind-the-scenes safeguards that people often overlook. But the peace of mind it offers? That’s hard to put a price on. Whether you’re buying your first place or investing in a second property, knowing you’re protected against title-related surprises can make the whole experience a lot smoother.

Just remember: while title insurance isn’t legally required, it’s often a wise move and having a real estate lawyer walk you through the details can save you a ton of confusion down the road.

Frequently Asked Questions

1. Do I have to renew title insurance annually?

No. Title insurance is a one-time purchase. It covers you for as long as you own the property, with no need for renewals or additional fees.

2. Can I get title insurance after I’ve already bought my home?

Yes, but the process is a bit different. You’ll need to contact a title insurance provider or your lawyer to arrange a “homeowner’s policy” retroactively. It’s still worth doing, especially if you’ve discovered title-related issues.

3. Does title insurance cover boundary disputes?

It depends. Some policies may include coverage for boundary or survey-related issues, but not all. Always check with your lawyer to understand what’s included in your policy.

4. Is title insurance mandatory when buying a condo?

It’s not mandatory by law, whether for a condo or house, but most lenders require it, and it’s still a good idea for personal protection either way.

Real Estate

Family Law

Wills & Estates

Immigration

Join Our Mailing List.

Sign up with your email to receive our newsletter and stay informed about the latest legal developments and special offers.